Virginia Defense Manufacturing and the Growing Opportunity for Regional Logistics

End of the $800 Tariff

All Industry News

Virginia Defense Manufacturing and the Growing Opportunity for Regional Logistics

Virginia defense manufacturing is entering a period of significant expansion. Bipartisan federal initiatives, strategic partnerships with allied nations, and renewed investment in shipbuilding and advanced production are converging to create unprecedented opportunities across the commonwealth. For businesses operating within the maritime and logistics ecosystem, these developments signal a shifting landscape that will require reliable supply chain support, experienced freight partners, and a commitment to operational excellence.

At Century Express Virginia, we follow these trends closely because they directly affect the businesses and industries we serve. As a trusted logistics partner at the Port of Virginia since 2007, we understand that growth in defense manufacturing will translate into increased cargo volumes, new shipping requirements, and heightened demand for dependable drayage and freight services throughout the Hampton Roads region and beyond.

This article examines the forces driving Virginia’s defense manufacturing growth, the regional assets that position the commonwealth for success, and what this expansion means for logistics providers and supply chain professionals.

Federal Investment Is Accelerating Defense Production

The United States is making substantial investments to rebuild and strengthen its defense and commercial maritime industrial base. Federal spending under the National Defense Industrial Strategy, the Maritime Action Plan, and the AUKUS partnership between Australia, the United Kingdom, and the United States is directing billions of dollars toward shipbuilding, advanced manufacturing, and related industries.

The recent announcement to establish a new class of battleships for the U.S. Navy further underscores the federal government’s commitment to revitalizing the nation’s shipbuilding and ship repair capabilities. These initiatives are not limited to a single administration. Bipartisan support spanning multiple years has created a sustained push to enhance defense manufacturing capacity, and Virginia stands at the center of this effort.

For logistics providers, this federal investment creates a ripple effect. Increased production requires raw materials, components, and specialized equipment to move efficiently through ports, rail yards, and highway networks. It also demands reliable outbound freight solutions to deliver finished products to military installations, contractors, and end users. The companies that support this supply chain must be prepared to handle higher volumes, tighter schedules, and cargo that requires specialized handling.

Why Virginia Is Positioned to Lead

Virginia holds a unique position in the national defense manufacturing landscape. The commonwealth combines strategic geographic advantages, an established industrial base, a skilled workforce, and deep connections to the federal government and military operations.

Hampton Roads as the Maritime Center of Gravity

Hampton Roads is the nation’s maritime and naval center of gravity. The region is home to the world’s largest naval base, Naval Station Norfolk, along with major shipbuilding operations at HII-Newport News Shipbuilding. More than 350 companies support multiple repair yards, and a concentration of military installations creates constant demand for defense-related goods and services.

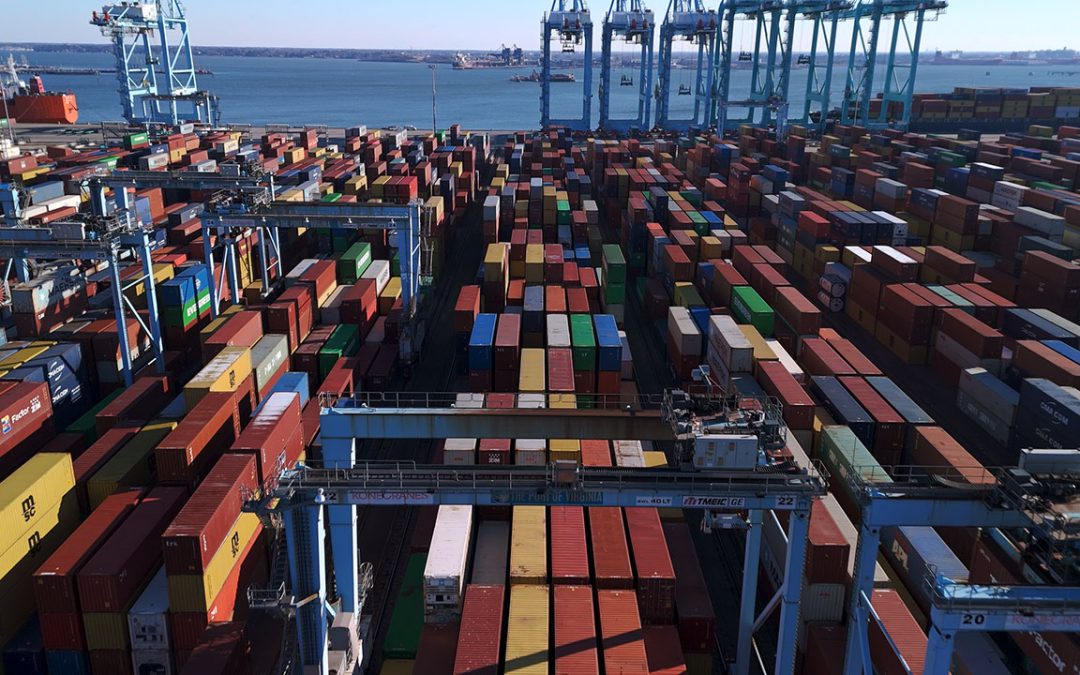

The Port of Virginia sits at the heart of this ecosystem. As one of the busiest and most efficient ports on the East Coast, it provides the infrastructure necessary to support large-scale manufacturing and distribution operations. The port’s deep channels, modern terminals, and strong inland connectivity make it an ideal gateway for both inbound materials and outbound finished products.

Century Express Virginia operates within this environment every day. Our team provides port drayage, rail drayage, transloading, and yard storage services that help businesses move cargo through the Port of Virginia efficiently and reliably. As defense manufacturing grows, so does the need for logistics partners who understand the complexities of port operations and can deliver consistent results.

A Workforce Ready for Advanced Manufacturing

Virginia’s workforce is another critical asset. The commonwealth has invested heavily in workforce development systems, including the Regional Maritime Training System, which prepares workers for careers in shipbuilding, maritime operations, and advanced manufacturing. Programs like GO Virginia have encouraged regional collaboration, aligning educational institutions, employers, and economic development organizations around shared goals.

Defense contractors and manufacturers require a skilled labor pool to meet production demands. Virginia’s commitment to workforce training means that companies locating or expanding in the region can access talent capable of supporting complex manufacturing processes. This workforce readiness also extends to the logistics sector, where trained drivers, dispatchers, and operations professionals are essential to keeping freight moving.

Headquarters for Major Defense Companies

Virginia is home to the headquarters of most major defense companies in the United States. This concentration of corporate leadership creates strong relationships between industry, government, and the military. It also means that decision-makers are close to the action, enabling faster coordination and more responsive supply chain planning.

When defense contracts are awarded and production timelines accelerate, having headquarters and manufacturing operations in the same region reduces friction. Logistics providers benefit from this proximity because it allows for closer collaboration with shippers and more accurate forecasting of freight volumes and requirements.

The Need for a Unified Statewide Strategy

While Virginia possesses remarkable assets, the commonwealth’s defense and maritime resources are not yet fully aligned under a unified statewide strategy. Industry leaders and regional organizations have called for a coordinated approach that brings together state agencies, private sector partners, and local governments to capture the full potential of federal investment.

A focused strategy would help Virginia compete more effectively with other states along the Gulf and Atlantic coasts that are aggressively pursuing defense manufacturing opportunities. States that align their resources, streamline permitting and regulatory processes, and actively market their capabilities to federal agencies and prime contractors will be better positioned to attract investment and jobs.

For the logistics industry, a unified strategy could mean clearer communication about infrastructure priorities, better coordination between port and rail operations, and increased investment in the transportation networks that support manufacturing growth. Century Express Virginia supports efforts to strengthen Virginia’s competitive position because a thriving defense manufacturing sector benefits every link in the supply chain.

What Defense Manufacturing Growth Means for Logistics

Expanding Virginia defense manufacturing will create new demands on the logistics ecosystem. Businesses that move freight through the Port of Virginia and across the Hampton Roads region should prepare for several developments.

Increased Cargo Volumes

As production ramps up, the volume of inbound raw materials, components, and equipment will rise. Steel, aluminum, electronics, specialized machinery, and other inputs will flow through the port and require efficient handling, storage, and delivery to manufacturing facilities. Outbound shipments of finished products, spare parts, and supplies will also increase.

Logistics providers must have the capacity, equipment, and operational flexibility to handle these higher volumes without sacrificing reliability or service quality. At Century Express Virginia, we maintain a diverse fleet and experienced team capable of scaling with customer needs.

Specialized Handling Requirements

Defense manufacturing often involves cargo that requires specialized handling. Oversized components, heavy machinery, hazardous materials, and temperature-sensitive goods may all be part of the supply chain. Logistics partners must have the expertise and equipment to manage these shipments safely and in compliance with all regulations.

Century Express Virginia offers hazmat drayage, heavy cargo permitting, refrigerated drayage, and specialized equipment services designed to meet the needs of shippers with complex freight requirements. Our experience handling diverse cargo types positions us to support defense-related supply chains.

Tighter Schedules and Higher Stakes

Defense contracts often come with strict deadlines and significant consequences for delays. When a shipyard needs a critical component to keep production on schedule, there is no room for error. Logistics providers must deliver precision and consistency to meet these expectations.

Reliability has always been central to our approach at Century Express Virginia. We understand that our customers depend on us to keep their supply chains moving, and we take that responsibility seriously. Our team works closely with port personnel, terminal operators, and customers to coordinate shipments and minimize delays.

Stronger Partnerships Across the Supply Chain

Growth in defense manufacturing will require stronger partnerships between shippers, logistics providers, ports, and rail operators. No single company can manage the complexity of a large-scale supply chain alone. Success depends on collaboration, communication, and a shared commitment to performance.

Century Express Virginia has built lasting relationships within the Port of Virginia community over nearly two decades of operation. We leverage these connections to help our customers navigate challenges and achieve their goals. As the defense manufacturing sector grows, these partnerships will become even more valuable.

Regional Investment Is Already Underway

Regions across Virginia are already investing heavily in maritime and defense production. Hampton Roads has seen tens of millions of dollars in state and federal funding directed toward infrastructure improvements, workforce training, and business development. The Hampton Roads Alliance recently released a Regional Investment Playbook focused on defense, maritime, energy, aerospace, and logistics, providing a coordinated plan for capturing growth opportunities.

These investments are creating momentum that benefits the entire logistics ecosystem. Improved infrastructure means faster freight movement. Expanded workforce training means more qualified workers. Coordinated economic development means a more attractive environment for businesses considering Virginia as a location for manufacturing or distribution operations.

Century Express Virginia is proud to be part of this regional ecosystem. We contribute to the success of businesses throughout Hampton Roads by providing dependable logistics services that keep cargo moving efficiently. As investment continues and the defense manufacturing sector expands, we remain committed to supporting our customers and the broader regional economy.

Looking Ahead

Virginia defense manufacturing is poised for substantial growth in the coming years. Federal investment, strategic partnerships, and the commonwealth’s natural advantages are combining to create a once-in-a-generation opportunity. Businesses that position themselves to support this growth will benefit from increased demand, stronger partnerships, and a more dynamic regional economy.

For logistics providers, the message is clear. The companies that invest in capacity, expertise, and relationships today will be best prepared to serve the defense manufacturing sector tomorrow. Century Express Virginia is ready to meet this moment. With decades of combined experience, a commitment to service excellence, and deep roots in the Port of Virginia community, our team is prepared to help customers navigate the opportunities ahead.

If your business is involved in defense manufacturing, shipbuilding, or related industries and you need a logistics partner who understands the demands of this sector, Century Express Virginia is here to help. Contact our team to discuss your freight requirements and learn how we can support your supply chain.